TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

☐

| Preliminary Proxy Statement |

☐

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒

| Definitive Proxy Statement |

☐

| Definitive Additional Materials |

☐

| Soliciting Material under §240.14a-12 |

| | |

| STONERIDGE, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing proxy statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| | | | | |

☒

| No fee required.required |

☐

| Fee paid previously with preliminary materials |

☐

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

TABLE OF CONTENTS

STONERIDGE, INC.

39675 MacKenzie Drive, Suite 400

Novi, Michigan 48377

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICEOFANNUALMEETINGOFSHAREHOLDERS

________________

Dear Shareholder:

We invite you to attend our 20222024 Annual Meeting of Shareholders (the “Annual Meeting”‘‘Annual Meeting’’) on Tuesday, May 17, 2022,14, 2024, at 11:00 a.m. (Eastern Time). The Annual Meeting can be accessed byon the Internet at www.virtualshareholdermeeting.com/SRI2022SRI2024. Because the Annual Meeting is virtual and being conducted electronically, shareholders cannot attend the meeting in person.

The purpose of the Annual Meeting is to consider and take action on the following items of business:

(1)

| To elect eight directors, each for a term of one year; |

(2)

| To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2022; |

(3)

| To vote on an advisory resolution to approve executive compensation; |

(4)

| To vote on a proposal to approve an amendment to the 2018 Amended and Restated Directors’ Restricted Shares Plan; and |

(5)

| To transact such other business as may be properly brought before the Annual Meeting and any postponement or adjournment thereof. |

(1)To elect nine directors, each for a term of one year;

(2)To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024;

(3)To vote on an advisory resolution to approve executive compensation;

(4)To vote on a proposal to approve an amendment to the 2018 Amended and Restated Directors’ Restricted Shares Plan, as amended; and

(5)To transact such other business as may be properly brought before the Annual Meeting and any postponement or adjournment thereof.

Record Date. Only shareholders at the close of business on March 25, 2022,22, 2024, the record date, are entitled to notice of and to vote at the Annual Meeting.

We urge you to vote your shares on the Internet, by toll-free telephone call or, if you have requested a paper copy of our proxy materials, by signing, dating, and returning the proxy card in the envelope provided.

By order of the Board of Directors,

ROBERT M. LOESCH Secretary

| | | By order of the Board of Directors,

|

| | | |

| | | ROBERT M. LOESCH

|

| | | Secretary

|

Dated: April 7, 20224, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 17, 2022:May 14, 2024:

This Proxy Statement and the Company’s 20212023 Annual Report to Shareholders are also available at www.proxyvote.com.

YOUR VOTE IS IMPORTANT. PLEASE VOTE.

20222024 Proxy Statement

Table of Contents

| | | | | |

| Page |

| | | |

| | | |

| | | |

| | | |

| | | | | | |

| | | | | | |

| | | |

| | | | | | |

| | | | | | |

| | | |

| | | |

| | | |

STONERIDGE, INC.

20222024 Proxy Statement SummaryThis summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

We are furnishing to our shareholders these proxy materials, which include this Proxy Statement and our 20212023 Annual Report to Shareholders, by providing access to themboth on the Internet at www.proxyvote.com. On or about April 7, 20224, 2024 we began mailing shareholders a Notice Regarding Availability of Proxy Materials (“Notice of Internet Availability”) containing important information, including instructions on how to access the proxy materials online and how to vote your shares over the Internet. If you receive a Notice of Internet Availability, you will not receive a paper or e-mail copy of the proxy materials unless you request one in the manner set forth in the Notice of Internet Availability.

The Board of Directors is soliciting proxies in connection with the 20222024 Annual Meeting of Shareholders (the “Annual Meeting”) and encourages you to read the Proxy Statement and vote your shares by Internet, by telephone call, or by mailing your proxy card or voting instruction form.

Stoneridge, Inc. 20222024 Annual Meeting Information

| | | | | |

| Date and Time: | | | Tuesday, May 17, 2022,14, 2024, at 11:00 a.m. (Eastern Time) |

Virtual Meeting: | | | Access the meeting at www.virtualshareholdermeeting.com/SRI2022SRI2024 |

Record Date: | | | March 25, 2022 22, 2024 |

Voting: | | | Shareholders as of the record date are entitled to vote. Each common share is entitled to one vote for each Director nominee and one vote for each of the other proposals presented for a vote. |

Matters to be Considered:

| Management Proposals | Management Proposals | | Board Vote

Recommendation | | Page for

more

information | | Management Proposals | Board Vote

Recommendation | Page for more information |

1. | | Elect eight directors named in this Proxy Statement | | FOR ALL | | | 1. | Elect nine directors named in this Proxy Statement | FOR ALL | |

2. | | Ratify the appointment of Ernst & Young LLP | | FOR | | | 2. | Ratify the appointment of Ernst & Young LLP | FOR | |

3. | | Provide advisory vote on executive compensation | | FOR | | | 3. | Provide advisory vote on executive compensation | FOR | |

4. | | Approval of an amendment to the 2018 Amended and Restated Directors’ Restricted Shares Plan | | FOR | | | 4. | Approval of an amendment to the 2018 Amended and Restated Directors’ Restricted Shares Plan, as amended | FOR | |

Company Performance

Our 2021 financial performance was impacted by external challenges, primarilyDuring 2023, we benefited from increased volumes in both our North American and European commercial vehicle markets, compared to the global coronavirus pandemic (“COVID-19”)prior year, due to improvements in end market demand and ongoinglaunches of previously awarded programs including launches for our MirrorEye® camera monitor system and our SE5000 Smart 2 tachograph. We continued to benefit from both previously agreed pricing actions, as well as incremental actions taken within the year with the majority of our customers, which offset a portion of the incremental material, supply chain disruptions, primarily related to semiconductor shortages. We were able to effectively navigate an incredibly volatile operating environment while at the same time continuing to execute on our long-term strategy. The Company believes that focusing on components and systems that address industry megatrends will have a positive impact on both our top-line growth and underlying margins.other input costs we incurred.

Net sales increased by $122.5$75.9 million, or 18.9%8.4%, compared to the prior year, due to higher sales in each of our segments. Our Control Devices segment net sales increased primarily as a result of recovery from 2020 COVID-19 impacts in our North American and China automotive markets. These increases were partially offset by a decrease in volumes in European automotive volumes due to the strategic exit of particulate matter sensor production and a decrease in volumes in our North American commercial vehicle market.Electronics segment. Our Electronics segment net sales increased primarily due to higher sales volumes in our European and North American commercial vehicle markets, including the launches of a next generation tachograph product for OEM and aftermarket applications in Europe and our first OEM MirrorEye program in North America, as well as the impact of negotiated price increases. This was partially offset by lower required electronic component spot buy purchases. Our Control Devices segment net sales decreased primarily due to a result of recovery from 2020 COVID-19 impactsdecrease in our North American automotive market, which was adversely impacted in the fourth quarter of 2023 by the UAW strike and European commercial and off-highwaya slower than expected penetration rate for electric vehicle marketsplatforms, as well as the launch of several new programs, favorable customer pricing for recoveries of semiconductor spot buy purchasesa decrease in our agricultural market. These decreases were offset by negotiated price increases and favorable foreign currency translation.an increase in our China commercial vehicle and automotive markets. Our Stoneridge Brazil segment net sales increased due to higher volumes for all of our product lines and for our Argentina market channel offset by unfavorable foreign currency translation.

favorable foreign currency translation and higher sales of our OEM products offset by lower sales demand for our other product lines.

Net incomeloss in 2021 increased2023 improved by $11.4$8.9 million compared to the prior year, primarily due to additional contribution from higher sales levels, including the gain on salebenefit of the Canton Facility of $30.7 millionnegotiated price increases and the pre-tax gain on the disposal of the Minda Stoneridge Instruments Ltd. joint venture of $1.9 million. This increase wasfavorable foreign exchange fluctuations offset by higher D&Dselling, general and administrative (SG&A) and design and development (D&D) spending, including higher business realignment costs, for new product launches andas well as higher SG&A including a net unfavorable fair value adjustment for Stoneridge Brazil earn-out consideration of $5.3 million.interest expense.

| | | | |

(in thousands, except earnings per share and share price) | | 2021 | | 2020 | (in thousands, except earnings per share and share price) | 2023 | 2022 |

Net sales | | $ 770,462 | | $ 648,006 |

Operating income (loss) | | 15,411 | | (7,664) |

Net income (loss) | | 3,406 | | (7,950) |

Diluted earnings (loss) per share attributable to Stoneridge, Inc. | | 0.12 | | (0.29) |

| Operating income | |

| Net loss | |

| Diluted (loss) earnings per share attributable to Stoneridge, Inc. | |

Share Price at December 31 | | 19.74 | | 30.23 |

Director Nominees

Below is a summary of the director nominees, who are elected for one-year terms. Additional information about each director nominee and his or her qualifications may be found beginning on page 56. | | | | Director

Since | | | | | Committee Memberships |

| | | | Committee Memberships | | | | | | Committee Memberships |

Name | | Age | | | Director

Since | | | Primary Occupation | | Independent | | AC | | CC | | NCGC | | CEC | Name | Age | Director

Since | Primary Occupation | Independent | AC | CC | NCGC | CEC |

Jonathan B. DeGaynor | | 55 | | President and CEO of Stoneridge, Inc. | | | | | | | | | | |

Jeffrey P. Draime | | 55 | | 2005 | | Self-employed business consultant | | ✔ | | | | ✔ | | ✔ | | |

| James Zizelman | |

| Ira C. Kaplan | |

| Ira C. Kaplan | |

Ira C. Kaplan | | 68 | | 2009 | | Executive Chairman of Benesch, Friedlander, Coplan & Aronoff LLP | | ✔ | | ✔ | | | | ✔ | | ✔ | 70 | 2009 | Executive Chairman of Benesch, Friedlander, Coplan & Aronoff LLP | ✔ | | ✔ | ✔ |

Kim Korth | | 67 | | 2006 | | President and CEO of 6th Avenue Group | | ✔ | | | | C | | ✔ | | ✔ |

William M. Lasky | | 74 | | 2004 | | Retired, Former President and CEO of Accuride Corporation | | L | | ✔ | | ✔ | | C | | |

| William M. Lasky | |

| William M. Lasky | |

George S. Mayes, Jr. | | 63 | | 2012 | | Self-employed business consultant | | ✔ | | | | | | | | C |

| George S. Mayes, Jr. | |

| George S. Mayes, Jr. | | 65 | 2012 | Self-employed business consultant | ✔ | | | ✔ | C |

| Carsten J. Reinhardt | |

| Sheila Rutt | |

| Sheila Rutt | |

| Sheila Rutt | | 55 | 2023 | Chief Human Resources Officer of Hexion Inc. | ✔ | | ✔ |

Paul J. Schlather | | 69 | | 2009 | | Self-employed business consultant | | ✔ | | ✔ | | | | | | ✔ | Paul J. Schlather | 71 | 2009 | Self-employed business consultant | ✔ | | | ✔ |

Frank S. Sklarsky | | 65 | | 2021 | | Retired, Former Executive Vice President and Chief Financial Officer of PPG Industries, Inc. | | ✔ | | C | | | | | | ✔ | Frank S. Sklarsky | 67 | 2021 | Retired, Former Executive Vice President and Chief Financial Officer of PPG Industries, Inc. | ✔ | C | | | ✔ |

| | | | | | | | | | | | | | |

| AC | | | Audit Committee | | C | | C

| | | Committee Chairperson |

CC | | | Compensation Committee | | * | | L

| | | Lead Independent Director |

NCGC | | | Nominating and Corporate Governance Committee | | | | | | |

CEC | | | Compliance and Ethics Committee | | | | | | |

Ratification of the appointment of Ernst & Young LLP

We are asking our shareholders to ratify the appointment of Ernst & Young LLP to serve as our independent registered public accounting firm for the year ending December 31, 2022.2024. For more information, see page 1013. Advisory resolution on executive compensation on the Say-on-Pay vote

We are asking our shareholders to approve, on an advisory basis, the compensation of our Named Executive Officers. For more information, see page 15. Amendment to the 2018 Amended and Restated Directors’ Restricted Shares Plan, as amended

We are asking our shareholders to approve an amendment to the 2018 Amended and Restated Directors’ Restricted Shares Plan, as amended, to increase the number of common shares authorized for issuance by 200,000. For more information, see page 16.

ii

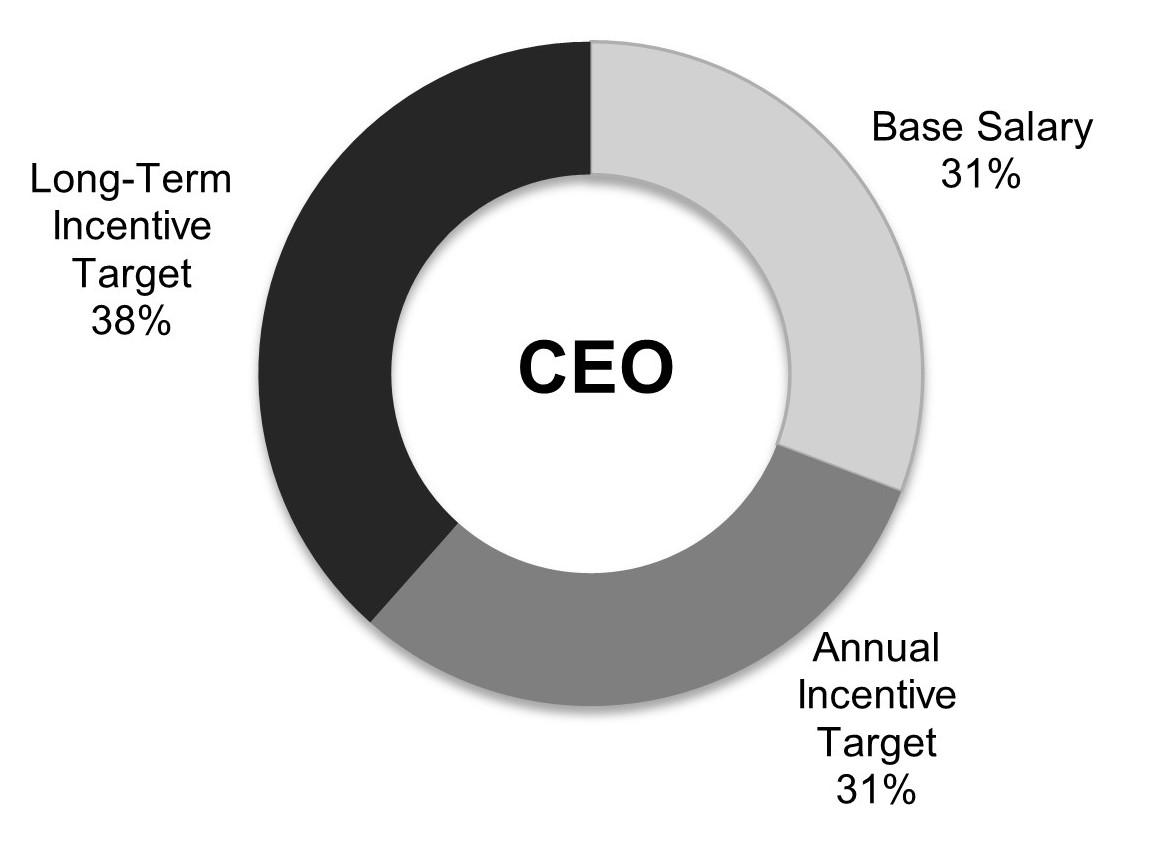

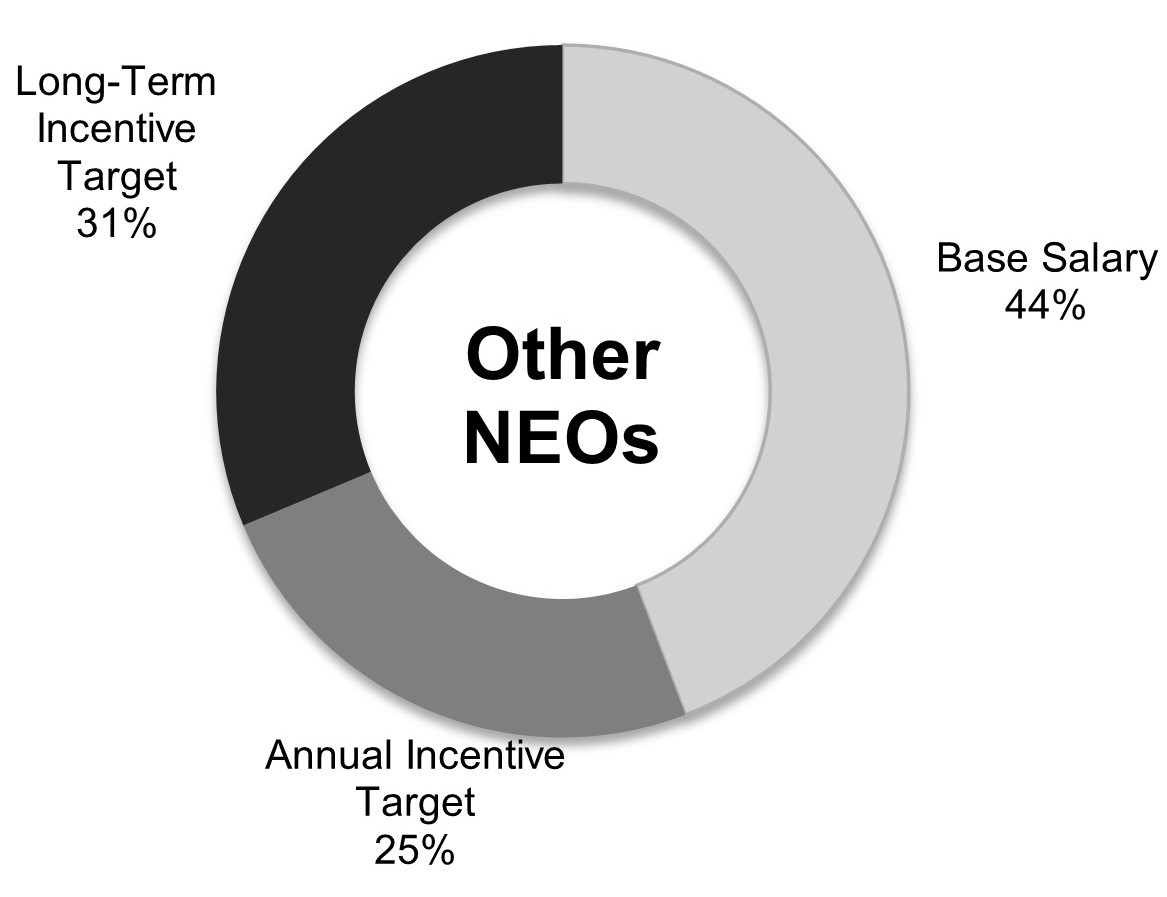

Executive Compensation Highlights

Our executive compensation program is designed to attract, retain, motivate and reward talented executives who advance our strategic, operational and financial objectives, and thereby enhance shareholder value. The primary objectives of our compensation programs for executive officers are to:

•Attract and retain talented executive officers by providing a compensation package that is competitive with that offered by similarly situated companies;

•Create a compensation structure under which a substantial portion of total compensation is based on achievement of performance goals; and

•Align total compensation with the objectives and strategies of our business and shareholders.

Key elements of our 20212023 compensation program were as follows:

• | Base Salary. Base salary has been targeted at the 50th percentile of our comparator group.

|

• | Annual Incentive Plan (AIP). The 2021 AIP was comprised of consolidated and, where appropriate, divisional financial performance metrics. In addition, there is an individual performance component.

|

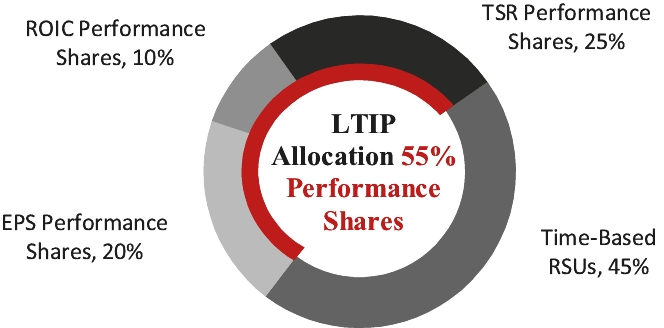

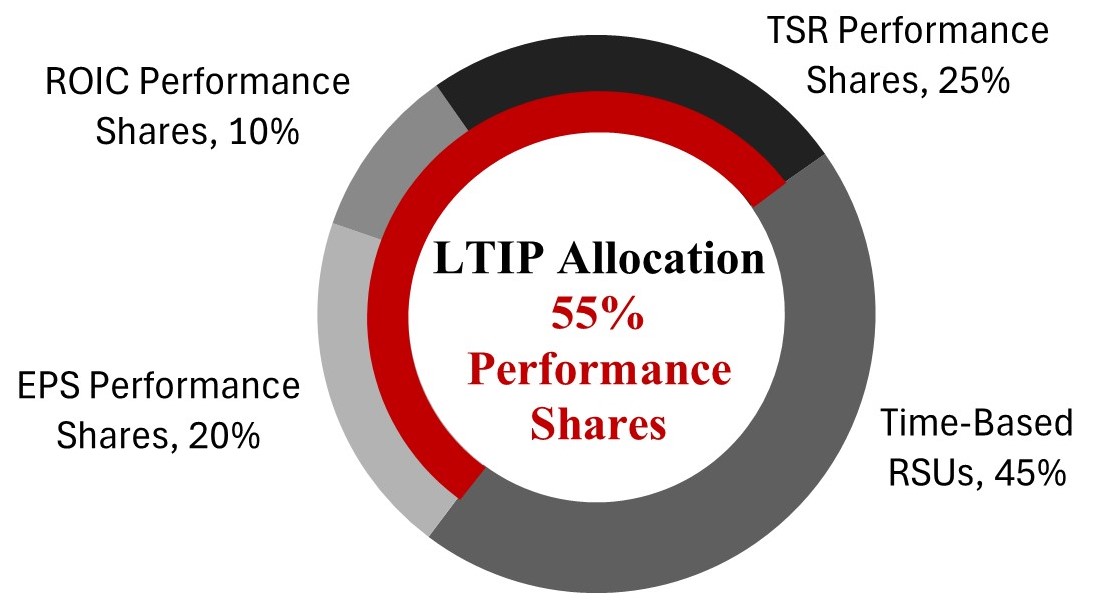

• | Long-Term Incentive Plan (LTIP). Long-term incentives were awarded under our Long-Term Incentive Plan for 2021 and targeted at approximately the 50th percentile of our comparator group. These awards will vest in three years and weight performance-based share units (“Performance Shares”) more heavily than time-based restricted share units (“RSUs”), and are allocated as follows: 25% of the Performance Shares vest subject to our Total Shareholder Return (“TSR”) over a three-year period compared to a group of peer companies; 20% vest based on our earnings per share (“EPS”) relative to budget over the three-year performance period; 10% vest based on our return on invested capital (“ROIC”) relative to budget over the three-year performance period; and 45% are RSUs that vest based on the passage of time.

|

•Base Salary. Base salary has been targeted at the 50th percentile of our comparator group.

•Annual Incentive Plan (AIP). The 2023 AIP was comprised of consolidated and, where appropriate, divisional financial performance metrics. In addition, there is an individual performance component.

•Long-Term Incentive Plan (LTIP). Long-term incentives were awarded under our Long-Term Incentive Plan for 2023 and targeted at approximately the 50th percentile of our comparator group. These awards will vest in three years and weight performance-based share units (“Performance Shares”) more heavily than time-based restricted share units (“RSUs”), and are allocated as follows: 25% of the Performance Shares vest subject to our Total Shareholder Return (“TSR”) over a three-year period compared to a group of peer companies; 20% vest based on our earnings per share (“EPS”) relative to budget annually over the three-year performance period; 10% vest based on our return on invested capital (“ROIC”) relative to budget annually over the three-year performance period; and 45% are RSUs that vest based on the passage of time.

For more information related to our executive compensation program, see page 1925. Corporate Governance Highlights

We believe that good corporate governance is key to achieving long-term shareholder value. We have adopted practices and policies that we believe serve the best interests of the Company and our shareholders, including:

7•Eight out of 8nine director nominees are independent directors

•Ongoing Board refreshment process; added two new independent directors in 2023, one of whom is gender diverse

•Independent Chairman of the Board who serves as the Board’s Lead Independent Director

25% percent•33% of our Board directormembers and nominees are ethnic/gender diverse

•11% of our Board members and nominees are racially/ethnically diverse

•Separation of the Chief Executive Officer and Chairman of the Board roles

•Annual Election of all Directors

•Majority Voting Principlevoting principle in uncontested director elections

•Independent directors regularly meet in executive session without management

•All Committee members are independent

•Shareholders’ ability to communicate with the Board

•Single class of stock with equal voting rights; one vote per Common Share

•Board establishment of a separate Compliance and Ethics Committee to oversee our Integrity Program

•Robust Integrity Program

•Code of Conduct

•Whistleblower Policy and integrity helpline reporting available in multiple languages

•Corporate Governance Guidelines

•Annual Board and Committee self-evaluations

•Meaningful stock ownership requirement for senior management and directors

•Annual advisory vote on named executive officer compensation

•Insider Trading and Pre-Clearance Policy, including prohibition against hedging and pledging of Company stock

•Review and approval of related party transactions

•Adoption of a Modern Slavery Act Statement

•Board and Compliance & Ethics Committee oversight of environmental, social and governance (“ESG”) management

•Board and Audit Committee oversight of cybersecurity and information security management

•NYSE compliant Recovery Policy

Board Oversight of our Human Capital Management

The Board is actively engaged in oversight of the Company’s human capital management. Annually, the Board meets to review our succession strategy and leadership pipeline for key roles, including our President and Chief Executive Officer. In addition, the Board regularly receives reports from the Chief Human Resources Officer and Assistant General Counsel and is briefed on our employee engagement survey results. Board members also are active partners, engaging and spending time with our high potential leaders throughout the year at Board meetings and other events. The Board’s Compensation Committee oversees compensation and seeks to ensure it is aligned with creating long-term shareholder value. The Board’s Compliance and Ethics Committee oversees our global compliance programs, in part,Integrity Program, which is critical to ensuredriving our ethical culture and ensuring all employees are treated fairly and with respect.

Oversight of ESG Management

The Board provides oversight and guidance of the Company’s ESG-related initiatives, and the Board Committees have various responsibilities connected to ESG matters. The Board’s Compliance and Ethics Committee provides oversight of the Company’s ESG policies, strategies and performance related to sustainability matters, corporate social responsibility, and ethics and compliance. The other Board committees receive updates and provide guidance on specific topics related to sustainability and other ESG-related topics that otherwise fall within their respective committee charters.

The Company’s internal cross-functional ESG Steering Committee continually works to refine Stoneridge’s overall ESG and sustainability efforts and meets regularly to oversee and monitor progress on our initiatives. The Company’s Director of Compliance and Environmental, Health and Safety (EH&S) leads the ESG Steering Committee and the Chief Human Resources Officer and Assistant General Counsel provides oversight and champions our key ESG and sustainability initiatives. The Director of Compliance and EH&S provides regular updates to the Executive Leadership Team and the Compliance and Ethics Committee on the Company’s ESG initiatives, including the efforts of the internal cross-functional ESG Steering Committee.

iv

PROXY STATEMENT

The Board of Directors (the “Board”) of Stoneridge, Inc. (the “Company”) is sending you this Proxy Statement to ask for your vote as a Company shareholder on matters to be voted on at our Annual Meeting of Shareholders to be held on Tuesday, May 17, 2022,14, 2024, at 11:00 a.m. (Eastern Time), for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Shareholders. The Annual Meeting will be held virtually. You can attend the Annual Meeting online, vote your shares electronically, and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/SRI2022SRI2024. You will need to have your 16-digit Control Number included on your Notice of Internet Availability or your proxy card (if you received a printed copy of the proxy materials) to join the Annual Meeting.

We are mailing shareholders a Notice of Internet Availability containing instructions on how to access the Proxy Materials and how to vote online on or about April 7, 2022.4, 2024.

Annual Report; Internet Availability

We are furnishing our proxy materials, which include this Proxy Statement, our Notice of Annual Meeting of Shareholders and our 20212023 Annual Report to Shareholders to shareholders by providing access to the proxy materials on the Internet at www.proxyvote.com. www.proxyvote.com. The Company anticipates that the Notice of Internet Availability in connection with our proxy solicitation materials will first be mailed on or about April 7, 20224, 2024 to all shareholders entitled to vote at the Annual Meeting and then we will post our proxy materials on the website referenced in the Notice of Internet Availability. As more fully described in the Notice of Internet Availability, all shareholders may choose to access our proxy materials on the website referred to in the Notice of Internet Availability or may request to receive, without charge, a printed set of our proxy materials.

Solicitation of Proxies

The Board is making this solicitation of proxies and we will pay the cost of the solicitation. We have retained D.F. King & Co., Inc., at an estimated cost of $15,000, plus expenses, to assist in the solicitation of proxies from brokers, nominees, institutions and individuals. In addition, our employees, without any additional remuneration, may solicit proxies by telephone or facsimile or other electronic means. We will also make arrangements with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materialmaterials to beneficial owners of our shares held of record by such persons, and we will reimburse such persons for their reasonable out-of-pocket expenses in forwarding solicitation material.

Proxies

The common shares represented by your proxy will be voted in accordance with the instructions indicated on your proxy card. In the absence of any such instructions, they will be voted to (i) elect the nine director nominees set forth under “Election of Directors”; (ii) ratify the appointment of Ernst & Young LLP as our registered public accounting firm for 2022;2024; (iii) approve on an advisory basis the compensation of our Named Executive Officers and (iv) approve thean amendment to the 2018 Amended and Restated Directors’ Restricted Shares Plan.Plan, as amended.

No business other than that set forth in the accompanying Notice of Annual Meeting of Shareholders is expected to come before the Annual Meeting. Should any other matter requiring a vote of shareholders properly arise, the persons named in the enclosed form of proxy will vote such proxy in accordance with their judgment.

Revocation of Proxies

Your participation at the Annual Meeting, without further action, will not revoke your proxy. However, if you are a registered shareholder you may revoke your proxy at any time before it has been exercised by:

•signing and delivering a later-dated proxy;

•voting again by Internet or telephone prior to 11:59 p.m. (Eastern Time) on May 16, 202213, 2024 (only the latest vote you submit will be counted);

•giving notice to the Company in writing at our address indicated on the attached Notice of Annual Meeting of Shareholders (the notification must be received by the close of business on May 16, 2022)13, 2024); or

by •voting at the Annual Meeting.

If you hold your common shares in “street name”, in order to change or revoke your voting instructions you must follow the specific voting directions provided to you by your bank, broker or other holder of record.

Virtual Shareholder Meeting

Holding a virtual Annual Meeting provides expanded access, improved communication and potential cost savings to our shareholders and our Company. We believe that holding a virtual Annual Meeting will enableenables more shareholders to attend and participate in the meeting because our shareholders can fully participate from any location with Internet access.

The Annual Meeting will be conducted exclusively online via live, audio-only, webcast, allowing all of the Company’s shareholders the option to participate in the live, online shareholder meeting from any location convenient to them. Only shareholders at the close of business on the record date may attend, vote and ask questions at the Annual Meeting by following the instructions provided. The virtual Annual Meeting can be accessed by visiting:

www.virtualshareholdermeeting.com/SRI2022SRI2024

You will need to have your 16-digit Control Number included on ourthe Notice of Internet Availability and/or your proxy card (if you received a printed copy of the proxy materials) to join and participate in the Annual Meeting. If you hold any of your shares through a bank, broker or other holder of record (i.e., in street name) the control number is issued to you by your bank, broker or other holder of record.

We encourage you to access the Annual Meeting before the start time of 11:00 a.m. (Eastern Time), on May 17, 2022.14, 2024. Please allow ample time for online check-in, which will begin at 10:3045 a.m. (Eastern Time) on May 17, 2022.14, 2024.

If you encounter difficulties accessing the virtual meeting, please call the technical support number that will be posted at www.virtualshareholdermeeting.com/SRI2022SRI2024.

Shareholders who participate in the virtual Annual Meeting by means of the hyperlink above will be deemed to be “present in person,”person”, as such term is used in this Proxy Statement, including for purpose of determining a quorum and counting votes.

Record Date and Voting Eligibility

Only shareholders at the close of business on the record date, March 25, 2022,22, 2024, are entitled to receive notice of the Annual Meeting and to vote the common shares held on the record date at the meeting. On the record date, our outstanding voting securities consisted of 27,315,15727,665,557 common shares, without par value, each of which is entitled to one vote on each matter properly brought before the meeting.

Voting

The Board is asking for your proxy in advance of the Annual Meeting. Giving your proxy means you authorize the individuals designated as proxies to vote your common shares at the Annual Meeting in the manner you direct. You may give your proxy or otherwise vote your common shares in one of several ways, depending on how you hold your shares.

Shareholders of Record

If your common shares are registered directly in your name with the Company’s transfer agent, you are considered the “shareholder of record” of those shares and you may vote:

•By Telephone. Telephone. You may vote by telephone by calling toll-free 1-800-690-6903 on a touch-tone phone until 11:59 p.m. Eastern Time on May 16, 2022.13, 2024. Please have your Notice of Internet Availability or proxy card in hand when you call. The telephone voting system has easy-to-follow instructions and provides confirmation that the system has properly recorded your vote.

•By Internet. Internet. You may vote your shares by proxy by visiting the website www.proxyvote.comuntil 11:59 p.m. Eastern Time on May 16, 2022.13, 2024. Please have your Notice of Internet Availability or proxy card in hand when you access the website. The website has easy-to-follow instructions and provides confirmation that the system has properly recorded your vote.

•By Mail. Mail. If you have requested or receive paper copies of our proxy materials by mail, you may vote your shares by proxy by signing, dating and returning the proxy card in the postage-paid envelope provided. Mailed proxy cards with respect to shares held of record should be mailed to allow sufficient time for delivery and tabulation. If you vote by telephone or over the Internet, you do not need to return your proxy card by mail.

•At the Annual Meeting. Meeting. You may vote your shares by attending the Annual Meeting by accessing www.virtualshareholdermeeting.com/SRI2022 SRI2024and voting using the 16-digit control number included on your proxy card and/or on your Notice of Internet Availability. However, you are encouraged to vote in advance of the Annual Meeting by mail, telephone or Internet even if you plan to participate in the Annual Meeting via the Internet.

Street Name Holders

•If you hold any of your shares through a bank, broker or other holder of record (i.e., in street name), you may be able to authorize your proxy for those shares by telephone, the Internet or mail. You should follow the instructions you receive from your bank, broker or other holder of record to vote these shares. If you are a street name holder and wish to vote during the virtual annual meeting you may use the 16-digit control number provided by your bank, broker or other holder of record. However, you are encouraged to vote in advance of the Annual Meeting by mail, telephone, Internet or Internetmail even if you plan to participate in the Annual Meeting via the Internet.

•If you do not instruct your broker, bank or other nominee on how to vote your shares, it will have discretionary authority, under New York Stock Exchange (“NYSE”) rules, to vote your shares on the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 20222024 (“Proposal 2”). However, your broker, bank or other nominee will not be permitted to vote your shares (a “broker non-vote”) on the election of directors (“Proposal 1”), the advisory vote to approve the compensation of our Named Executive Officers (“Proposal 3”), or the vote on the approval of thean amendment to the 2018 Amended and Restated Directors’ Restricted Shares Plan, as amended (“Proposal 4”).

3

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common shares as of February 28, 2022,March 4, 2024, by: (a) our directors and nominees for election as directors; (b) each other person who is known by us to own beneficially more than 5% of our outstanding common shares; (c) the executive officers named in the Summary Compensation Table; and (d) all of our executive officers and directors as a group.

Cooper Creek Partners Management LLC(2) | | | 1,919,793 | | | 7.1% |

BlackRock, Inc.(3) | | | 1,908,600 | | | 7.0 |

Cooke & Bieler LP(4) | | | 1,761,883 | | | 6.5 |

The Vanguard Group(5) | | | 1,401,379 | | | 5.2 |

T. Rowe Price Associates, Inc.(6) | | | 1,378,278 | | | 5.1 |

Jeffrey P. Draime(7) | | | 450,316 | | | 1.7 |

Jonathan B. DeGaynor(8) | | | 213,406 | | | * |

Paul J. Schlather(9) | | | 126,639 | | | * |

William M. Lasky(10) | | | 115,602 | | | * |

Ira C. Kaplan(11) | | | 72,654 | | | * |

Kim Korth(10) | | | 66,702 | | | * |

George S. Mayes, Jr.(10) | | | 55,722 | | | * |

Laurent P. Borne(12) | | | 8,434 | | | * |

Matthew R. Horvath(13) | | | 3,459 | | | * |

Douglas C. Jacobs(10) | | | 3,294 | | | * |

Frank S. Sklarsky(10) | | | 3,293 | | | * |

Susan C. Benedict(14) | | | 1,277 | | | * |

James Zizelman | | | — | | | * |

Robert R. Krakowiak | | | — | | | * |

Thomas M. Dono, Jr. | | | — | | | * |

All Executive Officers and Directors as a Group (18 persons) | | | 1,198,072 | | | 4.4% |

(1)

| Unless otherwise indicated, the beneficial owner has sole voting and investment power over such common shares. |

(2)

| According to a Schedule 13G filed with the SEC by Cooper Creek Partners Management LLC. The address of Cooper Creek Partners Management LLC is 501 Madison Avenue, Suite 302 New York, NY 10022. |

(3)

| According to a Schedule 13G/A filed with the SEC by BlackRock, Inc. The address of BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055. |

(4)

| According to a Schedule 13G filed with the SEC by Cooke & Bieler LP. The address of Cooke & Bieler LP is Two Commerce Square 2001 Market Street, Suite 4000 Philadelphia, PA 19103. |

(5)

| According to a Schedule 13G/A filed with the SEC by The Vanguard Group. The address of The Vanguard Group is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

(6)

| According to a Schedule 13G/A filed with the SEC by T. Rowe Price Associates, Inc. The address of T. Rowe Price Associates Inc. is 100 E. Pratt Street, Baltimore, MD 21202. |

(7)

| Represents 347,714 common shares held in trust for the benefit of Draime family members, of which Mr. Draime is trustee, 99,309 common shares owned by Mr. Draime directly and 3,293 restricted common shares subject to forfeiture (which vested on March 9, 2022). |

(8)

| Includes 36,701 time-based share units, which vest and are payable in common shares on a one-for-one basis on March 4, 2022. |

(9)

| Represents 47,500 common shares held in an investment retirement account for the benefit of Mr. Schlather, 75,846 common shares owned by Mr. Schlather directly and 3,293 restricted common shares subject to forfeiture (which vested on March 9, 2022). |

(10)

| Includes 3,293 restricted common shares subject to forfeiture (which vested on March 9, 2022). |

(11)

| Represents 69,361 common shares held in a trust, of which Mr. Kaplan is trustee, and 3,293 restricted common shares subject to forfeiture (which vested on March 9, 2022). |

(12)

| Includes 5,063 and 3,371 time-based share units, which vest and are payable in common shares on a one-for-one basis on March 4, 2022 and March 9, 2022, respectively. |

(13)

| Includes 2,413 time-based share units, which vest and are payable in common shares on a one-for-one basis on March 4, 2022. |

(14)

| Includes 462 time-based share units, which vest and are payable in common shares on a one-for-one basis on March 4, 2022. |

| | | | | | | | |

| Name of Beneficial Owner | Number of Shares Beneficially Owned(1) | Percent

of Class |

Thrivent Financial for Lutherans(2) | 2,983,741 | | 10.8 | % |

Frontier Capital Management Co., LLC(3) | 2,197,542 | | 8.0 | |

BlackRock, Inc.(4) | 2,134,380 | | 7.7 | |

Cooper Creek Partners Management LLC(5) | 1,996,185 | | 7.2 | |

Cooke & Bieler LP(6) | 1,637,414 | | 5.9 | |

Dimensional Fund Advisors LP(7) | 1,531,421 | | 5.6 | |

The Vanguard Group(8) | 1,478,425 | | 5.4 | |

Paul J. Schlather(9) | 155,909 | | * |

| William M. Lasky | 129,872 | | * |

Ira C. Kaplan(10) | 86,924 | | * |

| Kim Korth | 80,972 | | * |

| George S. Mayes, Jr. | 67,492 | | * |

Robert J. Hartman Jr.(11) | 34,688 | | * |

| Frank S. Sklarsky | 17,563 | | * |

James Zizelman(12) | 15,650 | | * |

Susan C. Benedict(13) | 11,124 | | * |

| Carsten J Reinhardt | 7,745 | | * |

| Sheila Rutt | 7,745 | | * |

Matthew R. Horvath(14) | 7,667 | | * |

Rajaey Kased(15) | 6,795 | | * |

Caetano R. Ferraiolo(16) | 2,500 | | * |

| Salvatore D. Orsini | — | | * |

| Peter Osterberg | — | | * |

| All Executive Officers and Directors as a Group (18 persons) | 632,646 | | 2.3 | |

* Less than 1%

(1)Unless otherwise indicated, the beneficial owner has sole voting and investment power over such common shares.

(2)According to a Schedule 13G/A by Thrivent Financial for Lutherans (25,170 sole voting power, 2,958,571 shared voting power, 25,170 sole dispositive power and 2,958,571 shared dispositive power). The address of Thrivent Financial for Lutherans is 901 Marquette Avenue, Suite 2500, Minneapolis, MN 55402.

(3)According to a Schedule 13G/A by Frontier Capital Management Co., LLC (1,403,916 sole voting power and 2,197,542 sole dispositive power). The address of Frontier Capital Management Co., LLC is 99 Summer Street, Boston, MA 02110.

(4)According to a Schedule 13G/A by BlackRock, Inc (2,076,043 sole voting power and 2,134,380 sole dispositive power). The address of BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055.

(5)According to a Schedule 13G/A by Cooper Creek Partners Management LLC (1,996,185 both sole voting and dispositive power). The address of Cooper Creek Partners Management LLC is 501 Madison Avenue, Suite 302, New York, NY 10022.

(6)According to a Schedule 13G/A by Cooke & Bieler LP (1,222,175 shared voting power and 1,637,414 shared dispositive power). The address of Cooke & Bieler LP is Two Commerce Square 2001 Market Street, Suite 4000, Philadelphia, PA 19103.

(7)According to a Schedule 13G by Dimensional Fund Advisors LP (1,499,533 sole voting power and 1,531,421 sole dispositive power). The address of Dimensional Fund Advisors LP is 6300 Bee Cave Road, Building One, Austin, TX 78746.

(8)According to a Schedule 13G by The Vanguard Group (24,980 shared voting power, 1,430,023 sole dispositive power and 48,402 shared dispositive power). The address of The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355.

(9)Represents 62,500 common shares held in an IRA for the benefit of Mr. Schlather, 76,714 common shares held in a trust, of which Mr. Schlather is trustee and 16,695 common shares owned by Mr. Schlather directly.

(10)Represents 75,886 common shares held in a trust, of which Mr. Kaplan is trustee and 11,038 common shares owned by Mr. Kaplan directly.

(11)Includes 1,395 time-based share units, which vest and are payable in common shares on a one-for-one basis on March 8, 2024.

(12)Includes 5,258 time-based share units, which vest and are payable in common shares on a one-for-one basis on March 8, 2024.

(13)Includes 2,865 time-based share units, which vest and are payable in common shares on a one-for-one basis on March 8, 2024.

(14)Includes 1,184 time-based share units, which vest and are payable in common shares on a one-for-one basis on March 8, 2024.

(15)Includes 2,112 time-based share units, which vest and are payable in common shares on a one-for-one basis on March 8, 2024.

(16)Includes 1,476 time-based share units, which vest and are payable in common shares on a one-for-one basis on March 8, 2024.

PROPOSAL ONE: ELECTION OF DIRECTORS

In accordance with the Company’s Amended and Restated Code of Regulations, the number of directors at the date of this Proxy Statement is fixed at nine. However, in accordance with the Company’s Amended and Restated Code of Regulations, the number of directors will be reduced to eight effective at the start of the Annual Meeting. At the Annual Meeting, shareholders will elect eightnine directors to hold office until our next Annual Meeting of Shareholders and until their successors are elected and qualified. The Board proposes that the eightnine nominees identified below be elected to the Board. Jonathan B. DeGaynor has an employment agreement with the Company that provides that during the term of the agreement he shall be entitled to be nominated for election to the Board. At our Annual Meeting, the common shares represented by proxies, unless otherwise specified, will be voted for the election of the eightnine nominees hereinafter named.

Mr. Douglas C. Jacobs, who will continue to serve on the Company’s Board up until the 2022 Annual Meeting, was not re-nominated for election to the Board at the Annual Meeting. The Company thanks Mr. Jacobs for his many years of valuable service as a Board member and as Chairman of the Board’s Audit Committee.

Directors are elected by a plurality of the votes cast at the Annual Meeting. Plurality means that the nominees who receive the most votes cast “For” their election are elected as directors. Votes withheld and broker non-votes will not affect the election of directors. Broker non-votes and abstaining votes will be counted as “Present” for purposes of determining whether a quorum has been achieved at the Annual Meeting, but will not be counted as “For” or “Withheld” from any nominee. “Plurality” means that the director nominees who receive the greatest number of votes cast are elected, up to theThe maximum number of directors to be elected at the meeting. The maximum numbernominees to be elected is eightnine and the proxies cannot be voted for a greater number of persons than the number of nominees named. Shares not voted will have no impact on the election of directors. Unless proper voting instructions are to “Withhold” authority for any or all nominees,At our Annual Meeting, the proxy givencommon shares represented by proxies, unless otherwise specified, will be voted “For” eachthe election of the nine nominees for director.hereinafter named.

Majority Voting Principle.

Under our Corporate Governance Guidelines, any nominee for director in an uncontested election who receives a greater number of votes “Withheld” than votes “For” must promptly offer his or her resignation. The Board’s Nominating and Corporate Governance Committee will then consider the resignation and recommend to the Board whether to accept or reject it. The Board will act on the Committee’s recommendation within 90 days after the Annual Meeting, and the Board’s decision will be publicly disclosed on Form 8-K. Any director who offers his or her resignation may not participate in the Board’s discussion or vote.

The director nominees nominated by the Board are identified below. If for any reason any of the nominees is not a candidate when the election occurs (which is not expected), the Board expects that proxies will be voted for the election of a substitute nominee designated by the Board. The following information is furnished with respect to each person nominated for election as a director.

The Board of Directors recommends that you vote FOR the following nominees.

Nominees to Serve for a One-Year Term Expiring in 20232025

| Jonathan B. DeGaynor

| | | Mr. DeGaynor, 55, is the President and Chief Executive Officer (“CEO”) of the Company and has served in this role since March 2015. Mr. DeGaynor served as the Vice President-Strategic Planning and Innovation of Guardian Industries Corp. (“Guardian”), a manufacturer of industrial glass and other building products for commercial, residential and automotive applications, from October 2014 until March 2015. Prior to that, Mr. DeGaynor served as Vice President-Business Development, Managing Director Asia for SRG Global, Inc., a Guardian company, and manufacturer of chrome plated plastic parts for the automotive, commercial truck and consumer goods industries, from August 2008.

| |

| |

| The Company believes that Mr. DeGaynor should serve as a director because he provides services as the Company’s President and Chief Executive Officer and because his extensive career in the automotive industry has spanned all phases of engineering, operations leadership, corporate strategy and business leadership. He brings expertise related to development and production of products and technologies. He provides valuable insight to the Board and strengthens the Board’s collective qualifications, skills and experience.

|

Jeffrey P. Draime

| | | Mr. Draime, 55, has served as a director since 2005. Since 2005, Mr. Draime has been a self-employed business consultant. Mr. Draime is a partner and the President of Aroma Aviation Holdings LLC, a charter aircraft corporation.

|

| |

| Mr. Draime served in various roles with the Company from 1988 through 2001, including operations, sales, quality control, product costing, and marketing. From 1999 to 2011 he was the owner of QSL Columbus/QSL Dayton, a restaurant franchise. From 2010 to 2020 Mr. Draime was President and partner of AeroMax Aviation Holdings, LLC. From 2017 to 2020 Mr. Draime has served as the Chairman of the Board of Directors of Aeromics, Inc., a clinical stage biotech company, and currently serves as director and as Chairman Emeritus of Aeromics, Inc. The Company believes Mr. Draime should serve as a director because he provides historical as well as an internal perspective of our business to the Board and strengthens the Board’s collective qualifications, skills and experience.

|

Ira C. Kaplan

| | | Mr. Kaplan, 68,70, has served as a director since 2009. Since January 2015 he has served as the Executive Chairman of Benesch, Friedlander, Coplan & Aronoff LLP, a national law firm, and served as the Managing Partner from 2008 until 2014. He is a member of the firm’s Executive Committee and has been a partner with the firm since 1987. Mr. Kaplan focuses his practice on mergers and acquisitions as well as public and private debt and equity financings. |

|

|

| Mr. Kaplan counsels clients in governance and business matters in his role at the law firm. In addition to his legal and management experience described above, the Company believes that Mr. Kaplan should serve as a director because he brings thoughtful analysis, sound judgment and insight on best practices to the Board, in addition to his professional experiences, which strengthen the Board’s collective qualifications, skills and experience.

|

TABLE OF CONTENTS

Kim Korth

| | | Ms. Korth, 67,69, has served as a director since 2006. Since May 2019,July 2022, Ms. Korth has served as the Managing DirectorChief Executive Officer of Engauge Workforce Solutions LLC.LLC, a staffing and contract manufacturing firm. Since June 2017, Ms. Korth has served as the President and Chief Executive Officer of 6th Avenue Group, a firm focused on improving the sustainability and adaptability of small to medium manufacturing and distribution firms. Prior to that, from January 2018 to December 2019, Ms. Korth was the Chief Executive Officer of bb7, a product development firm. Prior to that, from December 2012 until May 2017, Ms. Korth was the President and Chief Executive Officer and a director of Techniplas LLC, a privately held international group of plastics-focused manufacturing businesses. Prior to that, she served as President, Chief Executive Officer and as a director of Supreme Corporation, a manufacturer of truck and van bodies, from 2011 to 2012. Ms. Korth was the founder and owner of IRN Inc. from 1983 to 2014, a well-known firm focused on automotive supplier strategy issues. |

|

|

| Ms. Korth ishas also served on a membervariety of corporate boards (5 public companies and 12 private companies) over the boardcourse of directors and a member of the Audit Committee ofher career, including Burke E. Porter Machinery Company, Shape Corp., Unique Fabricating, Inc., (NYSE American: UFAB), a leader in engineeringAutocam, and manufacturing multi-material foam, rubber,Unwired Technology. Ms. Korth currently serves on the Boards of Engauge Workforce Solutions LLC and plastic components utilized in noise, vibration, and harshness management and air/water sealing applications for the transportation, appliance, medical, and consumer markets.she is Vice Chair of Garyline Inc’s Board of Directors. |

|

|

| Ms. Korth has several decades of experience in corporate governance issues, organizational design, and development of strategies for growth and improved financial performance for automotive suppliers. In addition to the knowledge and experience described above, the Company believes that Ms. Korth should serve as a director because she provides insight on industry trends and expectations to the Board, which strengthens the Board’s collective qualifications, skills and experience. |

| | | | | |

William M. Lasky

| | | Mr. Lasky, 74,76, has served as a director since 2004. Mr. Lasky served as President and Chief Executive Officer of Accuride Corporation (“Accuride”), a manufacturer and supplier of commercial vehicle components, from 2008 until his retirement in 2011. He served as the Chairman of the Board of Accuride from 2009 to 2012. Mr. Lasky served as President and Chief Executive Officer of JLG Industries, Inc., a diversified construction and industrial equipment manufacturer, from 1999 through 2006 and served as Chairman of the Board from 2001 through 2006. |

|

|

| Mr. Lasky has served on the Board of Directors of NUARI since 2019. NUARI is a federally chartered 501(c)(3) non-profit that serves the national public interest through the interdisciplinary study of critical national security issues including rapid research, development, and education in cybersecurity, defense technologies, and information advantage. From 2011 through 2016, Mr. Lasky also served as a director of Affinia Group, Inc., a designer, manufacturer and distributor of industrial grade replacement parts and services for automotive and heavy-duty vehicles. |

|

|

| In addition to his professional experience described above, the Company believes that Mr. Lasky should serve as a director because he provides in-depth industry knowledge, business acumen and leadership to the Board, which strengthen the Board’s collective qualifications, skills and experience.

|

TABLE OF CONTENTS

George S. Mayes, Jr.

| | | Mr. Mayes, 63,65, has served as a director since 2012. Mr. Mayes currently provides independent business consulting services. Previously, Mr. Mayes served as Executive Vice President and Chief Operating Officer of Diebold, Inc., a provider of integrated self-service delivery and security systems and services, from 2013 to 2015. Prior to that, he served as Executive Vice President of Operations from 2008, as Senior Vice President, Supply Chain Management from 2006 to 2008, and as Vice President, Global Manufacturing upon joining Diebold, Inc. in 2005. Since March 2021, Mr. Mayes has been a member of the board of directors of Forward Air Corporation (NASDAQ: FWRD), a leading asset-light freight and logistics company that provides services across the United States and Canada. On February 7, 2024, Mr. Mayes was appointed as the independent Chairman of the Board of Forward Air Corporation. |

|

|

| Mr. Mayes has extensive experience in global and lean manufacturing and Six Sigma processes and has managed manufacturing facilities in Canada, Mexico, France, Hungary, Brazil, China, Poland, Italy and the United States. He is a proven leader with a distinguished record of service and deep experience with global supply chain design and strategic development. Mr. Mayes is certified by the National Association of Corporate Directors in cyber security oversight risk management. |

|

|

| The Company believes that Mr. Mayes should serve as a director because he provides in-depth knowledge of manufacturing and operations, business acumen and leadership to the Board, which strengthen the Board’s collective qualifications, skills and experience.

|

| | | | | |

Carsten J. Reinhardt | Mr. Reinhardt, 56, was elected to the Board of Directors in February 2023. Mr. Reinhardt currently provides independent business consulting services that support enterprise strategy, operations improvement, sales growth, product management, human capital development, and mergers and acquisitions to various public and private companies in Europe and North America. From 2012 to 2016, Mr. Reinhardt served as President and Chief Executive Officer of Voith Turbo and as a member of the Board of Management of Voith Group, Heidenheim, Germany. Prior to that, from 2006 to 2011, Mr. Reinhardt served as an officer at Meritor Inc. as President of Commercial Vehicle Systems (2006 to 2009) and as Chief Operating Officer (2009 to 2011), with global responsibility for Meritor’s business segments including commercial truck, industrial/off-highway and aftermarket/trailer as well as manufacturing, research and development, purchasing and quality. From 1993 to 2006, Mr. Reinhardt served in various capacities at Daimler AG with increasing levels of responsibilities, concluding as President and Chief Executive Officer of Detroit Diesel Corporation from 2003 to 2006.

From October 2016 to present, Mr. Reinhardt has served as the Vice Chairman of the Board of Grundfos Holding A/S, Bjerringbro, Denmark, a privately-held global market leader providing fluid management and water treatment solutions. From 2017 to present, Mr. Reinhardt has served as a member of the Supervisory Board of SAF-Holland SE, Bessenbach, Germany, where he was a member of the Audit committee from 2017 to 2023, and a member of the Nomination and Compensation Committee from 2023 to present. SAF-Holland is a publicly traded company in Germany and a leading Tier 1 supplier to the commercial vehicle industry. Mr. Reinhardt also serves as chairman of the advisory board for tmax Holding GmbH, Mannheim, Germany, a specialty supplier of high-temperature insulation technologies, and is a member of the advisory board for Beinbauer Automotive GmbH, Buechlberg, Germany, a machining supplier to commercial vehicle and off-highway OEMs. From January 2024 until present, Mr. Reinhardt has been a member of the supervisory board of Samson AG, a privately held manufacturer of industrial valve and controls technology, based in Frankfurt, Germany.

The Company believes that Mr. Reinhardt should serve as a director because he has 30 years of experience in the global commercial vehicle industry (17 years in the USA and 13 years in Europe) and provides in-depth industry knowledge in the Company’s business, especially the commercial vehicle industry, business acumen and leadership to the Board as a result of his three decades of experience in the commercial vehicle and automotive industries, including executive leadership roles with some of the world’s leading commercial vehicle manufacturers and suppliers. Mr. Reinhardt’s background and experience strengthen the Board’s collective qualifications, skills and experience.

|

| | | | | |

Sheila Rutt | Ms. Rutt, 55, was elected to the Board of Directors in March 2023. Ms. Rutt has been the Chief Human Resources Officer of Hexion Inc., an advanced specialty chemical company, since July 2023. Ms. Rutt served as the Chief Human Resources Officer of Culligan International, a water treatment and filtration company, from May 2021 to July 2023. From 2017 to 2020, Ms. Rutt was Executive Vice President, Chief Human Resources Officer of RR Donnelley (NYSE: RRD), a Fortune 500 global integrated communication company providing marketing solutions, multichannel business communications, commercial printing and related services. Prior to that from 2000 to 2017, Ms. Rutt spent 17 years with Diebold Nixdorf Incorporated (NYSE: DBD), a company that automates, digitizes and transforms the way people bank and shop, serving in a variety of management roles, ultimately serving as the Chief Human Resources Officer (2005-2017). Ms. Rutt has a master’s degree in business administration from Walsh University (2004) and a PhD in industrial/organizational psychology from the University of Akron (1996).

The Company believes that Ms. Rutt should serve as a director because she is a recognized leader in human resource management, in structuring transforming organizations, as well as elevating and enhancing a company’s corporate culture. The Board believes that Ms. Rutt’s experience will help the Company continue to foster a performance-based and inclusive culture focused on accountability and collaboration and that her background and experience will assist the Board with the Company’s transformation and long-term strategy. Ms. Rutt’s background and experience strengthen the Board’s collective qualifications, skills and experience.

|

Paul J. Schlather

| | | Mr. Schlather, 69,71, has served as a director since 2009. Mr. Schlather currently provides independent business consulting services. Mr. Schlather was a partner at PricewaterhouseCoopers LLP, serving as co-head to the Private Client Service group from August 2002 until his retirement in 2008. Mr. Schlather also serves on the boards of five closely held businesses. |

|

|

| Mr. Schlather qualifies as an audit committee financial expert due to his extensive background in accounting and finance built through his career in public accounting. In addition to his professional and accounting experience described above, the Company believes that Mr. Schlather should serve as a director because he provides financial analysis and business acumen to the Board, which strengthen the Board’s collective qualifications, skills and experience.

|

| | | | | |

Frank S. Sklarsky

| | | Mr. Sklarsky, 65, was elected to the Board of Director on February 22,67, has served as a director since 2021. Mr. Sklarsky is currently servesa member of the board of trustees and a member of the executive committee and chairman of the investment committee at Rochester Institute of Technology. From 2019 to 2024, Mr. Sklarsky served on the Boardboard of Directorsdirectors of twothe privately held companies,company, Nexa3d, Inc., From 2018 to 2022, Mr. Sklarsky was a director and chairman of the audit committee at the privately held company Cenveo Worldwide Ltd. From 2012 to 2017, Mr. Sklarsky was a director and a member of the audit and compensation committees of Harman International (NYSE: HAR). From 2013 to 2017, Mr. Sklarsky served as Executive Vice President and Chief Financial Officer of PPG Industries, Inc. (NYSE: PPG). From 2010 to 2012, he was Executive Vice President and Chief Financial Officer of Tyco International. From 2006 to 2010 he was Executive Vice President and Chief Financial Officer of Eastman Kodak Company.Company (NYSE: KODK). From 2004 to 2006, he was Executive Vice President and Chief Financial Officer of Conagra Foods, Inc.Inc (NYSE: CAG). Earlier in his career, Mr. Sklarsky spent 20 years with Chrysler and DaimlerChrysler, serving in a series of management roles, ultimately rising to the position of vice president, Finance – Product Quality, Cost Management and Procurement. He also served in executive finance positions with Dell, Inc. He started his career as a CPA at Ernst & Young LLP. |

|

|

| Mr. Sklarsky qualifies as an audit committee financial expert due to his extensive accounting and financial background built through his experience in public accounting and his service as CFO at several large public companies. In his prior chief financial officer positions at four fortune 200 companies, Mr. Sklarsky was intimately involved in oversight and discussions with the firms’ IT departments related to cybersecurity matters. In addition to his professional, accounting and finance experience described above, the Company believes that Mr. Sklarsky should serve as a director because he provides vast experience in CFO roles, as well as the comprehensive management and leadership experience he has gained as a senior executive at multiple global corporations, which strengthen the Board’s collective qualifications, skills and experience.

|

James Zizelman | Mr. Zizelman, 63, is the President and Chief Executive Officer (“CEO”) of the Company and has served in this role since January 2023. Prior to that Mr. Zizelman served as President of the Control Devices Division since April 2020. Previously, Mr. Zizelman served as the Vice President of Engineering and Program Management for Aptiv from December 2017 to March 2019. Mr. Zizelman was employed at Delphi for more than 20 years, where he was last a Vice President of Engineering from 2016 to 2017.

The Company believes that Mr. Zizelman should serve as a director because he provides services as the Company’s President and Chief Executive Officer and because his extensive career in the automotive industry has spanned all phases of engineering, operations leadership, corporate strategy and business leadership. He brings expertise related to development and production of products and technologies. He provides valuable insight to the Board and strengthens the Board’s collective qualifications, skills and experience. |

Board Composition

The following matrix provides information regarding the composition of our Board, each of whom is also a nominee for election at the 2024 Annual Meeting.

| | | | | | | | | | | | | | |

| Board Diversity Matrix as of December 31, 2023 |

| Total Number of Directors: 9 |

| Part I: Gender Identity | Female | Male | Non-Binary | Undisclosed |

| Directors | 2 | 5 | 1 | 1 |

| Part II: Demographic Background |

| Hispanic | — | — | — | — |

| Native American or Alaskan Native | — | — | — | — |

| Asian | — | — | — | — |

| Black or African American | — | 1 | — | — |

| Native Hawaiian or Pacific Islander | — | — | — | — |

| White | 2 | 4 | 1 | — |

| Two or more races or ethnicities | — | — | — | — |

| Did not disclose demographic background | — | — | — | 1 |

PROPOSAL TWO: RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP

The Audit Committee of the Board currently anticipates appointing Ernst & Young LLP (“Ernst & Young”EY”) as our independent registered public accounting firm for the year ending December 31, 2022.2024. For 2021, Ernst & Young2023, EY was engaged by us to audit our annual financial statements, assess our internal control over financial reporting and to perform audit-related and tax services. We expect that representatives of Ernst & YoungEY will be present at the Annual Meeting, will have an opportunity to make a statement if they so desire, and are expected to be available to respond to appropriate questions from shareholders.

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the independent external audit firm retained to audit the Company’s financial statements. As a matter of good corporate governance, the Audit Committee requests that shareholders ratify its anticipated selection of Ernst & YoungEY to serve as our independent registered public accounting firm for 2022.2024.

Although ratification by shareholders is not legally required, the Board believes that the submission is an opportunity for the shareholders to provide feedback on an important issue of corporate governance. If our shareholders do not approve the appointment of Ernst & Young,EY, the appointment of our independent registered public accounting firm will be re-evaluated by the Audit Committee, but will not require the Audit Committee to appoint a different accounting firm. If the selection is not ratified, the Audit Committee will consider whether it is appropriate to select another independent registered public accounting firm. Even if the selection is ratified, the Audit Committee in its discretion may select a different independent registered public accounting firm at any time during 20222024 if it determines that such a change would be in the best interests of the Company and our shareholders.

Vote Required for Approval

Approval of this proposal requires the affirmative vote of a majority of the common shares present in person or by proxy and entitled to be voted on the proposal at our Annual Meeting. Abstentions will have the same effect as votes against the proposal. Broker non-votes will not be considered common shares present and entitled to vote on the proposal and will not have a positive or negative effect on the outcome of this proposal,proposal; however, there should be no broker non-votes on this proposal because brokers should have the discretion to vote uninstructed common shares on this proposal.

The Board of Directors recommends that you vote FOR Proposal Two.

Service Fees Paid to the Registered Public Accounting Firm

For the fiscal years ended December 31, 20212023 and 20202022 we retained Ernst & YoungEY to provide services in the following categories and amounts. The Audit Committee has considered the scope and fee arrangements for all services provided by Ernst & Young,EY, taking into account whether the provision of non-audit-related services is compatible with maintaining Ernst & Young’sEY’s independence.

| | 2021 | | 2020 |

| 2023 | | | 2023 | 2022 |

Audit Fees | | $1,832,100 | | $1,895,700 |

Audit Related Fees | | 308,200 | | 3,000 |

Tax Fees | | 260,400 | | 286,400 |

Total Fees | | $2,400,700 | | $2,185,100 |

Audit Fees.Audit fees include services associated with the annual audit of our consolidated financial statements, the audit of our internal control over financial reporting, the quarterly reviews of the financial statements included in our SEC Form 10-Q filings, certain international statutory audits and other services that are normally provided by the independent registered accountants in connection with regulatory filings.

Audit Related Fees.Fees. Audit Relatedrelated fees include services associated with assurance and related services that are reasonably related to the performance of the audit of the Company’s financial statements, and consist primarily of due diligence services in connection with acquisitions and divestitures and other attest services.

Tax Fees.Tax fees relate to tax planning, domestic and international tax compliance and tax advice.

Pre-Approval Policies and Procedures

The Audit Committee’s policy is to approve in advance all audit and permitted non-audit services to be performed for the Company by its independent registered public accounting firm. Pre-approval is

TABLE OF CONTENTS

generally provided for up to one year, is detailed as to the particular service or category of services and is generally subject to a specific budget. The Audit Committee also pre-approves particular services on a case-by-case basis. In accordance with this policy, the Audit Committee has delegated pre-approval authority to the Chairman of the Audit Committee. The Chairman may pre-approve services and inform the Audit Committee at the next scheduled meeting.

All services provided by Ernst & YoungEY during fiscal year 2021,2023, as noted in the previous table, were authorized and approved by the Audit Committee in compliance with the pre-approval policies and procedures described above.

Audit Committee Report

In accordance with its written charter, the Audit Committee assists the Board in fulfilling its responsibility relating to corporate accounting, our reporting practices, and the quality and integrity of the financial reports and other financial information provided by us to any governmental body or to the public. Management is responsible for the financial statements and the financial reporting process, including assessing the effectiveness of the Company’s internal control over financial reporting. The independent registered public accounting firm is responsible for conducting audits and reviews of our financial statements in accordance with standards established by the Public Company Accounting Oversight Board, expressing an opinion on the conformity of the Company’s financial statements in accordance with generally accepted accounting principles, and auditing and reporting on the Company’s effectiveness of internal controls over financial reporting. The Audit Committee is comprised of fivefour directors, each of whom is “independent” for audit committee purposes under the listing standards of the NYSE.

In discharging its oversight responsibility as to the audit process, the Audit Committee reviewed and discussed our audited financial statements for the year ended December 31, 2021,2023, with management, including a discussion of the quality, not just the acceptability, of the accounting principles; the reasonableness of significant judgments; and the clarity of disclosures in the financial statements. The Audit Committee also discussed with our independent registered public accounting firm, Ernst & Young,EY, the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC. The Audit Committee has received the written disclosures and letter from Ernst & YoungEY required by the applicable requirements of the Public Company Accounting Oversight Board regarding Ernst & Young’sEY’s communication with the Audit Committee concerning independence. The Audit Committee discussed Ernst & Young’sEY’s independence with Ernst & Young.EY. The Audit Committee also considered whether the provision of non-audit services by Ernst & YoungEY is compatible with maintaining Ernst & Young’sEY’s independence.

The Audit Committee discussed with our Internal Audit Director and Ernst & YoungEY the overall scope and plans for their respective audits. The Audit Committee also met with the Internal Audit Director and Ernst & Young,EY, with and without management present, to discuss the results of their examinations, their evaluations of our internal controls, and the overall quality of the Company’s financial reporting.

Based on the above-referenced review and discussions with management, the Internal Audit Director and Ernst & Young,EY, the Audit Committee recommended to the Board, and the Board approved, that the audited consolidated financial statements for fiscal 20212023 be included in the Company’s Annual Report on Form 10-K filed with the SEC.

The Audit Committee

Douglas C. Jacobs, Chairman*

Ira C. Kaplan

Frank S. Sklarsky, Chairman

William M. Lasky

Carsten J. Reinhardt

Paul J. Schlather

Frank S. Sklarsky

*

| Mr. Jacobs served as Audit Committee Chairman until March 15, 2022. On that same date, the Board elected Mr. Sklarsky as Audit Committee Chairman to succeed Mr. Jacobs in that role. |

PROPOSAL THREE: SAY-ON-PAY

As required by the Dodd-Frank Act and Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”) we provide our shareholders with the opportunity to cast an annual advisory non-binding vote to approve the compensation of our Named Executive Officers as disclosed pursuant to the SEC’s compensation disclosure rules (which disclosure includes the Compensation Discussion and Analysis, the compensation tables, and the narrative disclosures that accompany the compensation tables) (a “Say-On-Pay” proposal). We believe that it is appropriate to seek the views of shareholders on the design and effectiveness of the Company’s executive compensation program. Since 2011, our Board of Directors, upon the recommendation of the Company’s shareholders, has elected to hold an annual advisory vote on the Company’s executive compensation practices.

At the Company’s 20212023 Annual Meeting of Shareholders, 98%96% of the votes cast on the Say-On-Pay proposal voted in favor of the proposal. The Compensation Committee believes this affirmed shareholders’ support of the Company’s approach to executive compensation. In addition, at the 2023 Annual Meeting of Shareholders, 96% of the votes cast on the advisory non-binding vote on the frequency of future advisory votes on the compensation of the Company’s Named Executive Officers voted in favor of holding the Say-on-Pay proposal vote every year.

Our goal for the executive compensation program is to attract, motivate, and retain a talented, entrepreneurial and creative team of executives to provide operational and strategic leadership for the Company’s success in competitive markets. We seek to accomplish this goal in a way that rewards performance and is aligned with our shareholders’ long-term interests. We believe that our executive compensation program, which emphasizes performance-based compensation and long-term equity awards, satisfies this goal and is strongly aligned with the long-term interests of our shareholders.

Base compensation is aligned to be competitive in the industry in which we operate. Performance-based compensation (cash and equity) represents 44-53%50-75% of each executive officer’sNamed Executive Officer’s target compensation opportunity, with long-term incentives representing the largest portion of compensation. Targets for incentive compensation are based on financial performance targets and increasing shareholder value.

The Compensation Committee retains the services of an independent compensation consultant to advise the Committee on competitive compensation and compensation practices.

The Board recommends that shareholders vote FOR the following resolution:

“RESOLVED that the compensation paid to the Company’s Named Executive Officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.”

Because the vote is advisory, it will not be binding upon the Board or the Compensation Committee. The Board and the Compensation Committee value the opinions of our shareholders and will take into account the outcome of the vote when considering future decisions regarding executive compensation.

Vote Required for Approval

The affirmative vote of a majority of the common shares present or represented by proxy and voting at the Annual Meeting will constitute approval of this non-binding resolution. If you own common shares through a bank, broker or other holder of record, you must instruct your bank, broker or other holder of record how to vote in order for them to vote your common shares so that your vote can be counted on this proposal. Abstentions will have the same effect as votes against the proposal. Broker non-votes will not be considered common shares present and entitled to vote on this proposal and will not have a positive or negative effect on the outcome of this proposal.

PROPOSAL FOUR: APPROVAL OF AN AMENDMENT TO THE 2018 AMENDED AND RESTATED DIRECTORS’ RESTRICTED SHARES PLAN,

AS AMENDEDThe Company’s 2018 Amended and Restated Directors’ Restricted Shares Plan (the “DRSP”) was, upon the approval and recommendation of the Board of Directors, in accordance with the applicable law and the listing rules of the NYSE, approved by the Company’s shareholders at the 2018 Annual Meeting of Shareholders. The DRSP authorized 850,000 Company common shares for issuance, of which 52,989 common shares remain available to be issued. On March 15,issuance. In 2022, the Board of Directors approved an amendment (the “Amendment”(“Amendment No. 1”) to DRSP, subject to shareholder approval, to amend the DRSP, to increasewhich was approved by an additionalthe Company’s shareholders at the 2022 Annual Meeting of Shareholders. Amendment No. 1. increased by 100,000 common shares the number of common shares available for issuance under the DRSP, bringing the total to 950,000 common shares. On March 12, 2023, the Board of Directors approved an additional amendment (“Amendment No. 2”) to the DRSP, subject to shareholder approval, to further amend the DRSP, as amended by Amendment No. 1, to increase by an additional 200,000 common shares, the number of common shares available for issuance under the DRSP, bringing the total to 1,500,000 common shares. On April 4, 2024 18,308 common shares remain available for issuance under the DRSP, as amended by Amendment No. 1.

The Company is seeking approval of the Amendment No. 2 because the additional common shares available for issuance under the DRSP will assist the Company in achieving its goal of promoting growth and profitability. The DRSP is a key component to compensating the Company’s directors (see “Director Compensation” on page 3847”). The description of the DRSP and the Amendment No. 2 are subject to and qualified by Appendix A to this Proxy Statement (which sets forth the DRSP and the Amendment)Amendment No. 2). Summary of the Amendment No. 2 and DRSP

The •Amendment No. 2 will increase the number of common shares available for issuance by 100,000200,000 to bring thea total of 1,050,000 common shares available for issuance to 950,000.shares.